Complete Guide to Buying Property in Oman for Foreign Buyers + Residency Conditions 2025

Guide to Buying Property in Oman for Foreigners: Residency & Investment

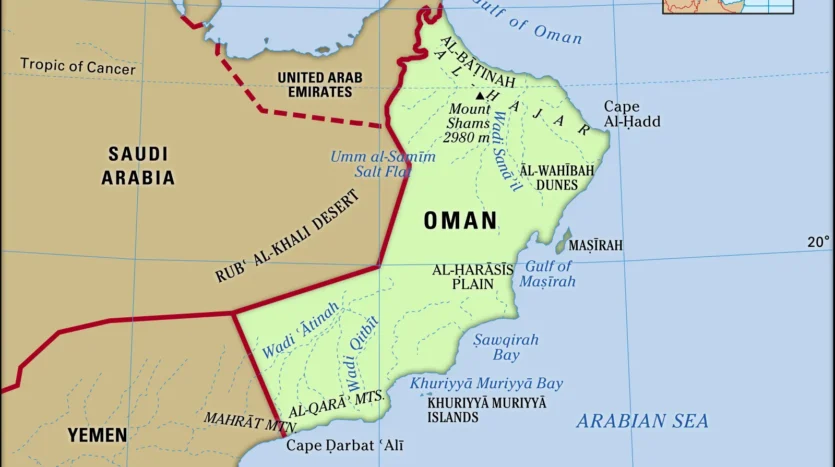

Introduction: Why Oman?

Oman is one of the most stable countries in the Gulf region, and in recent years, it has become a popular destination for property investors.

- High political, economic, and social stability

- Attractive tax exemptions

- Opportunity to obtain residency through property purchase

- Continuous growth in property values in selected areas

According to international reports, property values in Oman’s Integrated Tourism Complexes (ITCs) have experienced over 10% annual growth from 2021 to 2024.

Therefore, investing in property in Oman is both a golden opportunity to increase assets and to obtain residency in this peaceful and modern country.

Full Ownership (Freehold):

- After full payment of the property price and legal fees, the buyer receives freehold ownership (permanent and transferable to heirs).

- The official title deed (Mulkiah) is issued by Oman’s Ministry of Housing and Urban Planning.

Authorized Areas for Purchase:

Foreign nationals can only purchase property in specific projects known as Integrated Tourism Complexes (ITCs), such as:

- Al Mouj Muscat

- Jebel Sifa

- Muscat Bay

- Muscat Hills

- Salalah Beach

- Sultan Haitham City

- AIDA Project

- Yiti

- …

These projects offer luxury amenities including private beaches, shopping centers, international restaurants, and golf courses.

Section 2: Conditions for Obtaining Residency in Oman Through Property Purchase

By purchasing property in authorized projects, the buyer and their immediate family (spouse and children under 21) can apply for residency in Oman. The conditions are as follows:

- 2-Year Residency: Purchase property worth at least 100,000 Omani Rials.

- 5-Year Residency: Purchase property worth at least 250,000 Omani Rials.

- 10-Year Residency: Purchase property worth at least 500,000 Omani Rials.

Residencies are renewable, subject to maintaining investment conditions. Issuance of residency is subject to approval by Omani authorities and is not guaranteed by the seller.

Section 3: Property Purchase Process and Financial Obligations

Purchase Steps:

- Select property in one of the ITC projects.

- Sign the purchase agreement and pay the deposit.

- Open a bank account in Oman.

- Pay installments according to the agreed schedule.

- Pay Value Added Tax (5%).

- Pay title deed registration and annual service fees.

- Transfer the official title deed to the buyer’s name.

Financial Obligations:

- Full payment of the property price without deductions or offsets.

- Payment of 5% Value Added Tax (VAT).

- Payment of title deed registration, annual service, and maintenance fees.

- Payment of penalties for late installment payments: OMIBOR + 3%.

Restriction on Possession or Sale Before Full Payment:

Until the full price and related costs are paid, the buyer has no right to possess, lease, or sell the property. In some projects, contracts specify that after paying 60% of the installments, the buyer can proceed with the sale of the property.

Section 4: Contract Termination and Consequences

If the buyer fails to fulfill obligations such as non-payment of installments or violation of project regulations, the seller may terminate the contract. In this case, amounts paid may be fully or partially forfeited by the seller.

The buyer generally does not have the right to unilaterally terminate the contract unless explicitly provided in the agreement.

Upon termination, the seller is entitled to sell the property to a new buyer, and the previous buyer has no claim to any surplus from the resale.

Section 5: Impact of Political or Legal Status of the Buyer

If the buyer loses the ability to continue ownership or residency due to political issues, international sanctions, legal convictions, or deportation orders, the responsibility for selling the property and exiting ownership lies with the buyer. The seller bears no responsibility for changes in conditions or compensation in this regard.

Comparison of Property Purchase in Oman with Dubai and Turkey

Compared to Dubai and Turkey, purchasing property in Oman has its unique features and advantages that may appeal to investors.

- Property Tax in Oman:

In Oman, property tax is generally very low, and in some projects, property tax is zero. In contrast, in Dubai, property tax is typically 5% of the sale price, and in Turkey, there are annual property taxes and other related costs.

- Cost of Living in Oman:

The cost of living in Oman is usually lower than in Dubai and Turkey. Especially compared to Dubai, which is one of the most expensive cities in the Gulf, housing, transportation, food, and other services in Oman are more reasonable. In Turkey, the cost of living is lower than in Dubai, but some cities like Istanbul may have higher costs in certain areas.

- Oman Residency:

Residency conditions in Oman are simpler compared to Dubai, especially if property purchase is used as a tool for obtaining residency. To receive a 2-year residency in Oman, purchasing property worth at least 100,000 Omani Rials is sufficient, whereas in Dubai, the minimum investment amount for residency is significantly higher, and the residency process is more complex. Turkey also offers good residency conditions through property purchase, but administrative complexities due to frequent legal changes may pose challenges for some investors.

Common Mistakes by Foreign Buyers in Oman Property

Foreign buyers may encounter challenges when purchasing property in Oman, which can lead to serious problems if not aware of them. Some common mistakes include:

- Trusting Sellers Without Thorough Investigation:

One of the biggest mistakes is trusting sellers without conducting thorough research. In many cases, sellers may provide incomplete or even incorrect information, leading to legal and financial issues in the future. Therefore, consulting with a reputable lawyer or real estate advisor is crucial.

- Not Fully Reading the Contract:

Ignoring contract details is a common mistake. The purchase agreement should be carefully reviewed to ensure all details, including payment terms, additional costs, and rights and obligations of the parties, are clearly defined.

- Overlooking Additional Costs:

Some buyers focus only on the property’s base price and overlook additional costs such as VAT, registration fees, maintenance, and annual service charges. These costs can add up to a significant amount.

- Proceeding Without Residency Approval:

Some buyers may proceed with property purchase without verifying residency conditions, only to find out afterward that residency for themselves or their family is not possible. To avoid this issue, it is essential to carefully check residency status before purchasing property.

Restrictions on Oman Property Purchase for Foreigners

In Oman, like many countries, there are restrictions on property purchase by foreigners, and being aware of them can prevent problems:

- Restrictions in Strategic and Agricultural Areas:

Purchasing property in certain strategic or agricultural areas is prohibited for foreigners. These restrictions are in place to preserve natural resources and national security. Typically, these restrictions include areas near borders or politically sensitive regions.

- Ownership in ITC Projects:

Foreigners are only permitted to purchase property in Integrated Tourism Complexes (ITCs). In these projects, buyers can receive full ownership (Freehold). These projects usually include luxury amenities and services designed to facilitate foreign investment.

Frequently Asked Questions (FAQ)

Yes, in authorized ITC projects, full and permanent ownership is granted.

No, residency issuance is subject to the final decision of Omani authorities and is not guaranteed.

For 2-year residency, at least 100,000 Omani Rials; for 5-year residency, 250,000 Omani Rials; and for 10-year residency, 500,000 Omani Rials are required.

Yes, residency extends to the buyer’s spouse and children under 21.

Property ownership remains intact even without residency.

Selling is only possible with written permission from the seller and payment of transfer fees.

Property Purchase Checklist in Oman

- Select property in authorized ITC projects

- Sign purchase agreement

- Pay deposit and installments

- Pay taxes and registration fees

- Obtain security clearance (if required)

- Pay installments as per schedule

- Register title deed

- Apply for residency (if desired)

Call to Action:

✅ If you intend to make a secure investment in one of Oman’s premier projects

✅ If you’re seeking residency through property purchase

✅ If you want to navigate all steps confidently with expert consultation

Contact our specialists today or complete the free consultation form.

We will be with you every step of the way.